All Categories

Featured

Table of Contents

You after that purchase the auto with cash money. Generational wealth with Infinite Banking. The debate made in the LIFE180 video clip is that you never obtain anywhere with a sinking fund. You deplete the fund when you pay cash for the car and restore the sinking fund only to the previous degree. That is a substantial misconception of the sinking fund! The cash in a sinking fund earns passion.

That is how you keep up with rising cost of living. The sinking fund is constantly growing using interest from the conserving account or from your cars and truck payments to your lorry sinking fund. It additionally takes place to be what infinite banking conveniently fails to remember for the sinking fund and has excellent recall when related to their life insurance policy item.

That, we are informed, is the rise in our cash money value in year two. The genuine boast should be that you contributed $220,000 to the infinite financial policy and still just have a Cash money Worth of $207,728, a loss of $12,272 up to this point

What is the minimum commitment for Borrowing Against Cash Value?

You still have a loss regardless what column of the estimate you use.

Currently we transform to the longer term price of return with infinite financial. Before we disclose the real lasting rate of return in the whole life plan estimate of a marketer of boundless banking, let's ponder the idea of connecting so much money up in what in the video clip is referred to as an interest-bearing account.

The only means to turn this right into a win is to make use of defective math. First, assess the future value calculator below - Financial leverage with Infinite Banking. (You can use a range of various other calculators to get the very same outcomes.) After ten years you manage a bit more than a 2% annual rate of return.

What do I need to get started with Infinite Banking Concept?

The concept is to get you to think you can earn cash on the cash obtained from your unlimited banking account while at the same time accumulating a revenue on various other investments with the exact same cash. When you take a loan from your entire life insurance coverage policy what really occurred?

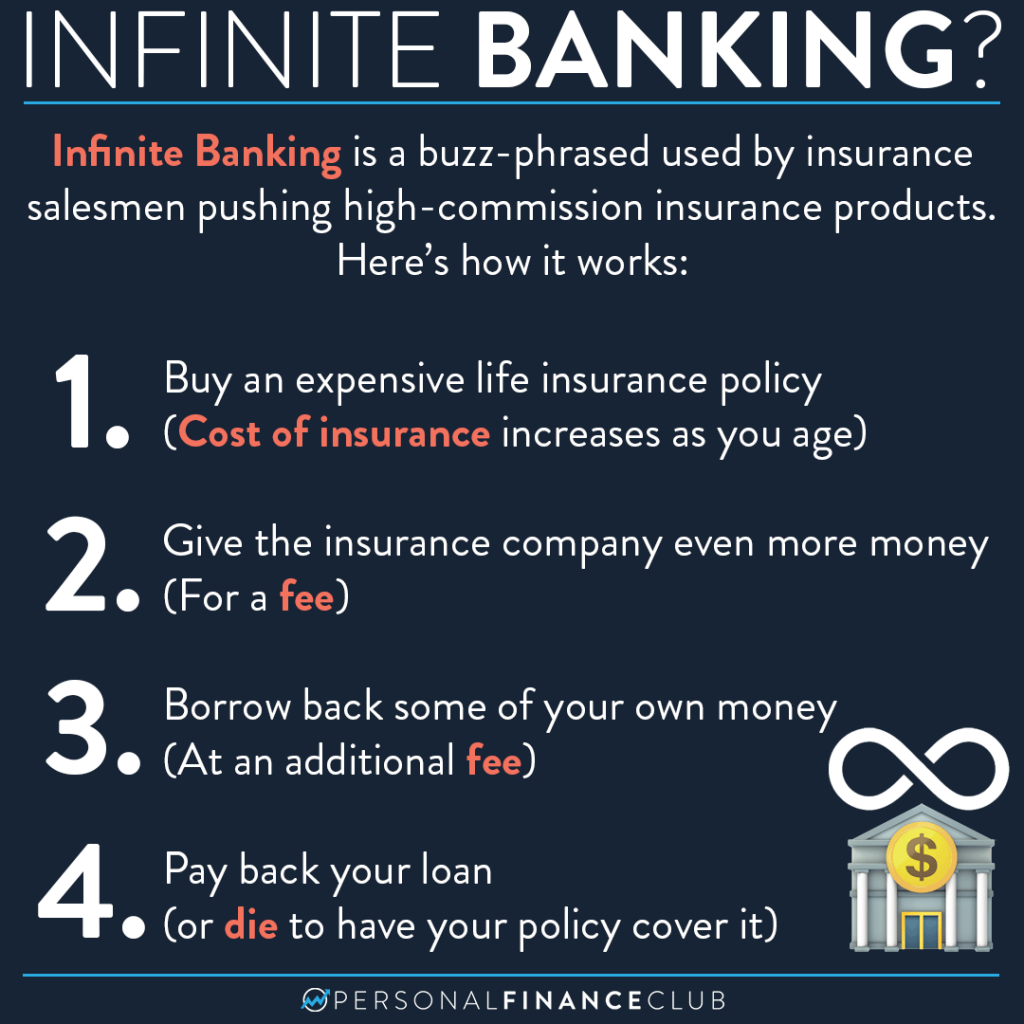

The "effectively structured whole life plan" bandied about by sellers of unlimited financial is actually just a life insurance policy business that is possessed by insurance policy holders and pays a returns. The only factor they pay a reward (the interest your money value makes while borrowed out) is because they overcharged you for the life insurance.

Each insurance coverage business is different so my example is not an excellent match to all "appropriately structured" limitless financial examples. THIS IS AN ADDITIONAL FINANCING OF YOUR INFINITE FINANCIAL ACCOUNT AND NOT EXPOSED IN THE ILLUSTRATION!

How do interest rates affect Wealth Management With Infinite Banking?

Also if the insurer attributed your money worth for 100% of the rate of interest you are paying on the financing, you are still not obtaining a complimentary adventure. Infinite Banking for financial freedom. YOU are spending for the interest attributed to your cash worth for the quantities loaned out! Yes, each insurance coverage firm whole life plan "properly structured" for boundless financial will certainly differ

Below is one headache unlimited banking proponents never want to speak about. When you pass away, what happens with your entire life insurance policy? Your beneficiaries get the fatality advantage, as guaranteed in the agreement between you and the insurance provider. Remarkable! What occurs to the cash money worth? The insurer maintains it! Bear in mind when I pointed out the car loan from your money worth comes from the insurance provider general fund? Well, that is since the cash money worth comes from the insurance company.

I might take place, yet you get the point. There are lots of achilles' heels to the unlimited banking principle. Life insurance firms and insurance coverage agents love the concept and have adequate reason to be blind to the deadly problems. In the long run there are only a couple of reasons for making use of irreversible life insurance policy and boundless banking is not one of them, no issue exactly how "appropriately" you structure the policy.

This in no other way indicates you require to go right into financial debt so you can use this approach. The following approach is a variant of this strategy where no debt is required. The only reason I begin with this approach is due to the fact that it can generate a bigger return for some individuals and it likewise helps you "leave debt faster." Right here is how this method works: You will certainly need a home loan and credit line.

How do I track my growth with Leverage Life Insurance?

Your normal mortgage is now paid down a little bit much more than it would certainly have been. As opposed to keeping more than a token quantity in your checking account to pay costs you will certainly go down the money into the LOC. You currently pay no rate of interest because that quantity is no much longer obtained.

If your LOC has a greater rate of interest rate than your mortgage this strategy runs right into issues. If your home loan has a higher rate you can still use this technique as long as the LOC interest rate is comparable or lower than your home loan passion rate.

The anybody can use (Infinite Banking wealth strategy). Limitless financial, as advertised by insurance coverage agents, is developed as a large interest-bearing account you can obtain from. Your initial cash keeps earning even when borrowed out to you while the borrowed funds are purchased other revenue producing possessions, the supposed double dip. As we saw above, the insurance provider is not the warm, fuzzy entity giving out complimentary money.

If you get rid of the insurer and invest the exact same monies you will certainly have more because you do not have middlemen to pay. And the passion rate paid is most likely higher, depending upon current rates of interest. With this in mind, Treasury Direct is an outstanding tool for building wide range with your excess funds allocated for financial savings and no state income taxes.

What type of insurance policies work best with Infinite Banking For Retirement?

You can withdraw your money any time. You can always call it obtaining your very own cash if you want. The exact same concept deals with cash markets accounts at banks (financial institutions or credit report unions). Right here is the magic of limitless banking. When you obtain your own money you likewise pay on your own a passion rate.

Latest Posts

How To Create Your Own Bank

Nelson Nash Ibc

Be Your Own Bank